Menu

Giving You Peace of Mind with the Best in Life Insurance Products

Life Insurance

Life insurance policies offer financial support to your family and loved ones upon your death. These plans are contracts between you and the insurer, where the insurer pays a specific amount of money to your beneficiaries.

There are many different types of life insurance policies. At Garrett Insurance, we offer a variety of plans to give you peace of mind.

Disability Insurance

Disability insurance provides financial coverage if you become injured or sick to the point of being unable to work. This is an important insurance policy to have if you or your family rely on your income. These policies can be either short-term or long-term.

Individual Life Insurance

There are two types of individual life insurance policies: term and permanent.

Term life insurance provides coverage for a predetermined period, while permanent life insurance covers the duration of your life.

Request a FREE Quote

Group Life Insurance

Employers can purchase group life insurance policies for their employees. Group life insurance saves money because the premiums tend to be lower than for individual policies.

Key Person Insurance

Key person insurance provides businesses with financial support if an important employee dies. These policies can help businesses continue to operate when losing that key employee would have otherwise caused significant financial losses.

Long-Term Care Insurance

If you suspect you may need assisted living or nursing home care at some point, you may need a long-term care insurance policy. This policy can cover those costs, which tend to be exorbitant.

Mortgage Protection Insurance

Mortgage protection insurance is designed to pay off your mortgage upon your death. These insurance policies help provide financial security to your family by ensuring they are not burdened with your mortgage payments if you pass away.

Second-to-Die Insurance

A second-to-die insurance policy is usually purchased by married couples, though it can apply to other family members or partners. This policy pays a death benefit after two people pass away. The payouts usually help cover expenses like estate taxes.

Life Insurance

At Garrett Insurance, we understand life insurance is an important consideration when planning for the safety and security of you and your loved ones. Contact us today to speak with one of our experienced representatives about life insurance.

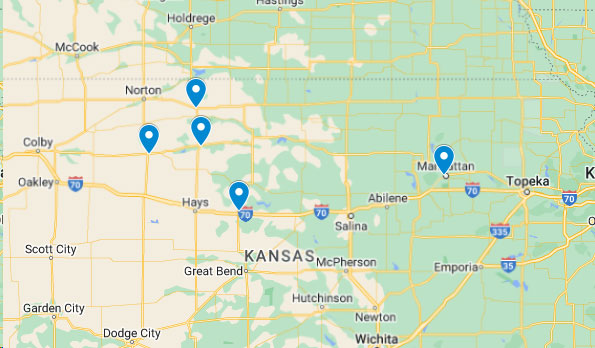

OUR AGENCY LOCATIONS

OUR PROMISE TO YOU

- We will provide customized solutions and personalized products based on your needs.

- We will be available to you any time so getting important information will be easy for you.

- We will manage your risk as well as any claims that you file.

- We will ease your worry and protect your treasures by transferring identified risks to an insurance product, all the while keeping it simple to understand for you.

We welcome an opportunity to discuss your home insurance needs, so please contact us or give us a call. You can also request a quote if you’re ready to get started.

Let the Garrett Insurance Family give you the Peace of Mind to Focus on What Matters Most to YOU.

TESTIMONIALS

Superior customer service and we’ve been with them for over a decade. They shop the best rates and coverage. We have multiple lines of business through Garrett Insurance and are loyal customers because of their service.

Holly Kallemyn

Walked in and was immediately greeted and directed to an office to discuss changing from my prior property/casualty carrier to see if I could get better rates. Linda was very friendly and knowledgeable. Got quote results promptly and decided to go with new carrier. Linda was available at my convenience to submit the paperwork, and I received my new policies promptly. Will not hesitate to recommend this agency if asked.

Candace Corwin

Great insurance agency !!! I highly recommend them for any of your needs. Be sure to talk to Linda Areolla she’s very thorough knowledgeable and sweet.

Michael Vega

We are very happy with the professionalism of Garrett Insurance. We have been paying for insurance (with many different companies) for over 50 years and we agree, this is the best agency we have dealt with. They are very quick to send an adjuster and handle our claims. They are also most affordable!

Carole Bell

Great service, great local company.

Kyle Bond

Positive: Professionalism, Responsiveness

Eddie Walker

Easy, fast, great service. My number 1 go to for insurance.

Positive: Professionalism, Quality, Responsiveness, Value

Mitchell Davis

Very helpful, good service. Friendly staff

Jay Graves

Trish was so helpful and professional. Great experience setting up health insurance for our company.

Hal Krebs

Very friendly and great with answering my questions. Nice and pleasant atmosphere. Melissa is very nice and courteous. I recommend this company.

Vicki Frost

Very reasonable on insurance and their staff is very helpful and friendly!!

Curt Counts

Garry Stapel

Regina Godinez

Best service. Great customer service. Super fast whatever you need, they’ll make sure you get it! You, ladies, are the best!

Gina Michelle

Positive: Professionalism, Responsiveness

Chelsey Peterson