Menu

Giving You Peace of Mind with the Best in Home Insurance Products

HOME INSURANCE

Home insurance is important in protecting your property and assets against accidents, weather-related disasters, and theft.

At Garrett Insurance, we offer a wide array of home insurance options so our clients can find the best coverage for what matters most.

Request a FREE Quote

Homeowners Insurance Policies

Homeowners Liability

Homeowners liability insurance protects you in the event someone becomes injured on your property. It can also offer protection if you accidentally cause damage to someone else’s property. Your policy can help cover the medical expenses, legal fees, or other costs associated with these incidents.

Property Insurance

Property insurance covers your property, including your home, after damage caused by:

- Theft

- Weather-related natural disasters

- Fire

- Certain other events

This type of insurance covers the structure of your home and your personal possessions, such as electronics, furniture, and appliances.

Other Types of Home Insurance

There are other variations of home insurance for individuals who do not own single-family homes, including:

- Condo insurance

- Mobile home insurance

- Renters insurance

These policies combine elements of homeowners liability and property insurance for individuals who live in condos, mobile homes, or rented homes or apartments.

Condo insurance covers the condo’s interior and your personal belongings. It also offers liability protection if someone is injured on your property.

Mobile home insurance covers the structure of the home and your possessions while also offering liability protection.

Renters insurance covers your belongings and offers liability protection. It also can help pay for additional living expenses if you need to relocate temporarily due to a covered event like a fire.

Landlord Insurance

Landlord insurance is for property owners who rent out their apartments or homes to tenants. These policies include:

- Coverage for the building

- Liability protection

A landlord insurance policy can also cover loss of rental income if the property is damaged to the point of being uninhabitable.

In-Home Business

For individuals who operate businesses from their homes, in-home business insurance offers protection from losses associated with liability claims or business-related property damage.

Scheduled Property

Scheduled property insurance is an add-on option for your policy that helps cover damage to high-value items like antiques, artwork, and jewelry.

Home Insurance

For all your home insurance needs, contact Garrett Insurance. Our team will guide you through choosing and obtaining comprehensive coverage for your most valued possessions, protecting your assets from accidents and losses.

OUR TRUSTED PROVIDERS

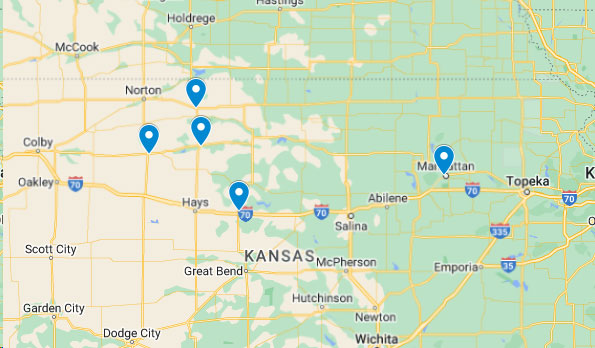

OUR AGENCY LOCATIONS

OUR PROMISE TO YOU

- We will provide customized solutions and personalized products based on your needs.

- We will be available to you any time so getting important information will be easy for you.

- We will manage your risk as well as any claims that you file.

- We will ease your worry and protect your treasures by transferring identified risks to an insurance product, all the while keeping it simple to understand for you.

We welcome an opportunity to discuss your home insurance needs, so please contact us or give us a call. You can also request a quote if you’re ready to get started.

Let the Garrett Insurance Family give you the Peace of Mind to Focus on What Matters Most to YOU.

TESTIMONIALS

Superior customer service and we’ve been with them for over a decade. They shop the best rates and coverage. We have multiple lines of business through Garrett Insurance and are loyal customers because of their service.

Holly Kallemyn

Walked in and was immediately greeted and directed to an office to discuss changing from my prior property/casualty carrier to see if I could get better rates. Linda was very friendly and knowledgeable. Got quote results promptly and decided to go with new carrier. Linda was available at my convenience to submit the paperwork, and I received my new policies promptly. Will not hesitate to recommend this agency if asked.

Candace Corwin

Great insurance agency !!! I highly recommend them for any of your needs. Be sure to talk to Linda Areolla she’s very thorough knowledgeable and sweet.

Michael Vega

We are very happy with the professionalism of Garrett Insurance. We have been paying for insurance (with many different companies) for over 50 years and we agree, this is the best agency we have dealt with. They are very quick to send an adjuster and handle our claims. They are also most affordable!

Carole Bell

Great service, great local company.

Kyle Bond

Positive: Professionalism, Responsiveness

Eddie Walker

Easy, fast, great service. My number 1 go to for insurance.

Positive: Professionalism, Quality, Responsiveness, Value

Mitchell Davis

Very helpful, good service. Friendly staff

Jay Graves

Trish was so helpful and professional. Great experience setting up health insurance for our company.

Hal Krebs

Very friendly and great with answering my questions. Nice and pleasant atmosphere. Melissa is very nice and courteous. I recommend this company.

Vicki Frost

Very reasonable on insurance and their staff is very helpful and friendly!!

Curt Counts

Garry Stapel

Regina Godinez

Best service. Great customer service. Super fast whatever you need, they’ll make sure you get it! You, ladies, are the best!

Gina Michelle

Positive: Professionalism, Responsiveness

Chelsey Peterson