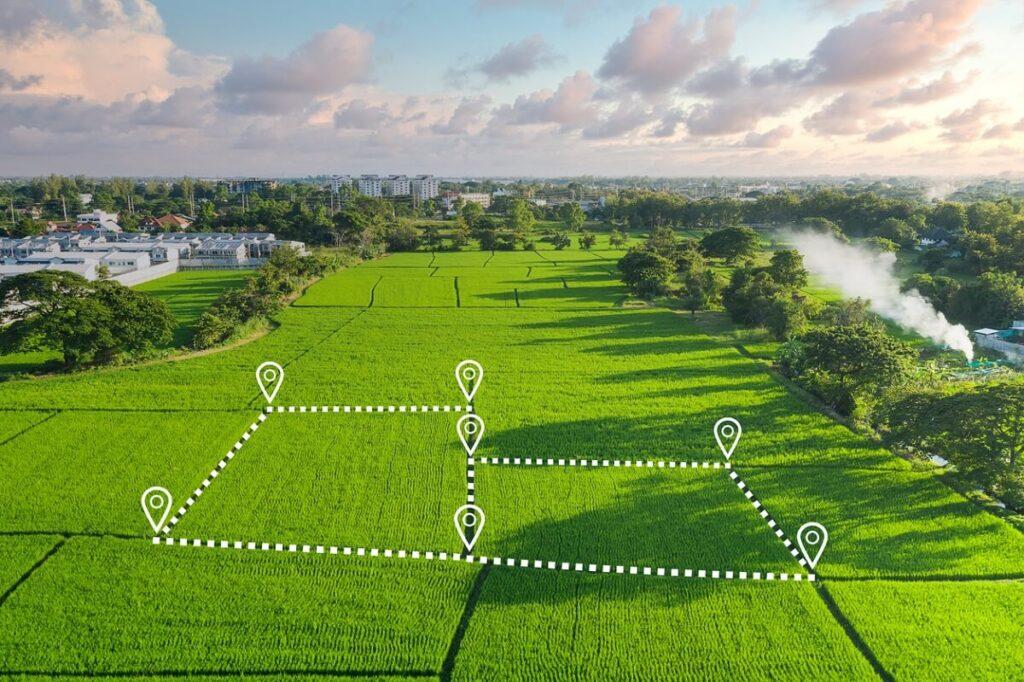

Operating any business without insurance poses a significant risk to your livelihood. So if you’re a farmer or rancher, you should consider protecting your property with farm and ranch insurance (sometimes colloquially referred to as “land insurance”) to help offset any losses you might incur.

What Is Farm and Ranch Insurance?

Farm and ranch insurance acts as a safety net to financially protect your equipment, livestock, and infrastructure from natural disasters and other incidents. If your home is on the property, you might be able to add it to the policy as well, including any detached garages or other buildings that you might reserve for personal use.

Finally, it can also provide liability protection if someone is injured on your property and you are found to be at fault.

Farm and Ranch Insurance

Farm and ranch insurance is a blanket term that encompasses everything from livestock to irrigation. But as you look for the right policy for your needs, it’s important to ensure it covers your specific needs. A good policy will protect all aspects of your farming or ranching operation.

What Types of Coverages Are Available?

As you identify the best coverage for your situation, you should be aware of several types of policies.

Farm Insurance

Farm insurance protects the farm’s property and can include coverage of buildings, equipment, livestock, and other assets.

Farm Livestock Insurance

In many cases, farm insurance will only partially protect your livestock. Animal insurance, by contrast, protects against losses from accidents or unexpected events. It can be customizable to your particular livestock (cattle, chickens, pigs, sheep, etc.) and is offered at several levels. Depending on how vital livestock is for your livelihood, it’s worth digging deep to find the right level of protection.

Equine Insurance

If you own horses, this valuable coverage can protect you from losses due to mortality, theft, injury, or veterinary expenses from medical care. It can also cover your liability for bodily injury and property damage to others.

Farm Equipment Insurance

Farm equipment coverage protects your farm’s most important tools and machinery from damage or theft. It can help you repair or replace important equipment to ensure that you maintain your farm or ranch’s productivity.

Farm Dwelling and Structures Insurance

Many people live on the farms they operate. In these situations, dwelling insurance can be quite helpful. Dwelling insurance is simply homeowners insurance that covers the primary structure on the farm, which is the home.

Farm structure or outbuilding insurance protects other structures on the farm. It covers things like cabins, barns, and silos from losses due to lightning, fire, storms, theft, or vandalism.

Farm Liability Insurance

Many of the previously mentioned policies contain some liability insurance to protect you from possible damages others might experience due to things like injury, property damage, and medical payments. That said, you might still consider getting dedicated liability insurance, which extends the amount of liability for additional protection. If you have frequent guests or visitors, it can be a smart addition.

Farm Umbrella Insurance

A farm and ranch liability umbrella policy adds another layer of extra coverage over and above your other policy limits. It protects you from losses due to vehicle accidents, product liability, livestock-related damage, or injury to others.

Umbrella coverage kicks in when claims exceed your primary coverage and can extend the range of other types of policies with higher coverage limits (frequently in the seven figures). When it rains, it pours, and an umbrella policy is there to help keep you from getting financially soaked.

These policies can be a bit overwhelming to sift through. Still, it is important to read each policy carefully, raise any concerns, and get all your questions answered to make sure you have a full understanding of all the costs and coverage.

Selecting the Right Policy for Farm and Ranch Insurance

Having the right insurance protection is critical for farmers and ranchers. When choosing suitable farm and ranch insurance, there are several factors you will need to consider.

Size of the Operation

More extensive operations tend to require more coverage.

Type of Crops or Livestock You Raise

Different crops/livestock carry different levels of risk, which will impact the kind and amount of coverage you need.

Location of the Operation

Suppose that you are in an area that’s near large population centers, or that is prone to natural disasters or climate-related impacts like drought. In these cases, you will want to ensure adequate coverage for events and liability.

The Replacement Cost vs. Actual Cash Value of Structures and Equipment

What is the current value of essential structures and equipment? What impact would losing the use of these have on your operations? How difficult would it be to replace quickly?

Ease of Access to Insurance Company

When disaster strikes, the last thing you want to do is make dozens of phone calls to a generic 1-800 number to explain to someone unfamiliar with your situation why you need immediate help. Instead, you must find a trusted partner who:

- Is easy to reach

- Knows and understands you and your unique needs

- Can navigate the paperwork quickly and efficiently

You need someone in your corner to act as a tireless advocate for you.

Get the Coverage You Need

Having the right coverage can provide financial protection and peace of mind, allowing you to focus on running your farm or ranch. However, navigating the world of insurance can be confusing, especially with all the options available for farm and ranch insurance.

When choosing the right farm and ranch insurance, it’s essential to remember that coverage can vary greatly depending on the specific insurer and policy. That is why it’s vital to work with a trusted insurance agent who understands your needs and specializes in this type of coverage.

The right insurance partner will help you talk through your options to develop comprehensive coverage that perfectly matches your individual needs. It doesn’t matter if you own 5 acres or 5,000; your insurance agent needs to understand the unique challenges and risks farmers and ranchers face. Only then can they provide the right policies to protect your assets.

Partner with Garrett Insurance

At Garrett Insurance, we specialize in farm and ranch insurance. As independent agents, we work with multiple insurance companies offering custom-tailored insurance coverage and programs for farms and ranches. We can answer all your questions, simplify the process, and create an insurance coverage package specifically designed for your unique needs and risks. Contact us today so we can show you how we have been helping to protect our clients and their farming operations for over 100 years.