Menu

Giving You Peace of Mind with the Best in Commercial Insurance Products

COMMERCIAL INSURANCE THAT MEETS YOUR NEEDS

Your business works hard to deliver consistent, top-quality service. At Garrett Insurance Agency, we’d like to return the favor. When you choose one of our commercial insurance solutions, you can rest assured that your business will be thoroughly protected. We’re proud to offer a comprehensive range of commercial and business insurance products.

Our Commercial Insurance Products

Protect your business with a customized policy that includes property insurance, general liability insurance, crime insurance, and any other types of coverage you need.

Covers your company if a work vehicle causes injury or damage, or if the vehicle itself is damaged.

Prevent major financial losses in the event of a property damage or bodily injury claim against your business.

Protect your buildings, inventory, and other commercial property from loss or damage.

Request a FREE Quote

Inland Marine Insurance

Cover buildings under construction and any business property being transported over land.

Professional Liability

Protect your business against claims of negligence, faulty work, mismanagement of company assets, unlawful employment practices, etc.

Crime Insurance

Recoup business losses if you fall victim to fraud, robbery, burglary, employee dishonesty, or other types of crime.

Cover medical care and lost wages if an employee is injured on the job.

Give your company extra coverage to shield you in the event of a major lawsuit.

Bonds

Protect your company from certain kinds of liability. For example, fidelity bonds protect you if you suffer a loss due to employee dishonesty or fraud. Surety bonds will compensate a client if you fail to complete a contract.

Marine Insurance

Protect your business’s property as it’s transported over land and sea. We offer several marine insurance options, including the following:

- Loss control service

- General liability

- Umbrella coverage

- Property insurance

No two businesses are the same, so we’ll work with you to develop a customized policy.

Get the Commercial Insurance Coverage You Need

Don’t go another day without the insurance you need to protect yourself and your business. Contact Garrett Insurance Agency today to get started.

OUR TRUSTED PROVIDERS

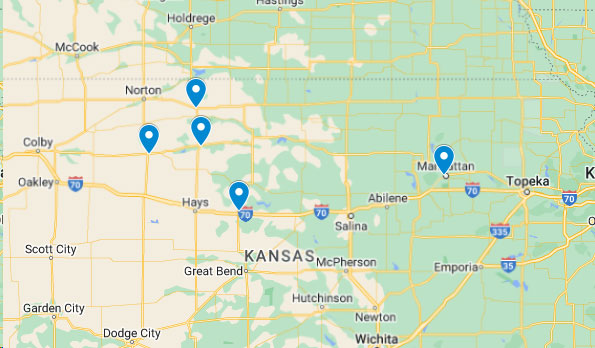

OUR AGENCY LOCATIONS

OUR PROMISE TO YOU

- We will provide customized solutions and personalized products based on your needs.

- We will be available to you any time so getting important information will be easy for you.

- We will manage your risk as well as any claims that you file.

- We will ease your worry and protect your treasures by transferring identified risks to an insurance product, all the while keeping it simple to understand for you.

We welcome an opportunity to discuss your home insurance needs, so please contact us or give us a call. You can also request a quote if you’re ready to get started.

Let the Garrett Insurance Family give you the Peace of Mind to Focus on What Matters Most to YOU.

TESTIMONIALS

Superior customer service and we’ve been with them for over a decade. They shop the best rates and coverage. We have multiple lines of business through Garrett Insurance and are loyal customers because of their service.

Holly Kallemyn

Walked in and was immediately greeted and directed to an office to discuss changing from my prior property/casualty carrier to see if I could get better rates. Linda was very friendly and knowledgeable. Got quote results promptly and decided to go with new carrier. Linda was available at my convenience to submit the paperwork, and I received my new policies promptly. Will not hesitate to recommend this agency if asked.

Candace Corwin

Great insurance agency !!! I highly recommend them for any of your needs. Be sure to talk to Linda Areolla she’s very thorough knowledgeable and sweet.

Michael Vega

We are very happy with the professionalism of Garrett Insurance. We have been paying for insurance (with many different companies) for over 50 years and we agree, this is the best agency we have dealt with. They are very quick to send an adjuster and handle our claims. They are also most affordable!

Carole Bell

Great service, great local company.

Kyle Bond

Positive: Professionalism, Responsiveness

Eddie Walker

Easy, fast, great service. My number 1 go to for insurance.

Positive: Professionalism, Quality, Responsiveness, Value

Mitchell Davis

Very helpful, good service. Friendly staff

Jay Graves

Trish was so helpful and professional. Great experience setting up health insurance for our company.

Hal Krebs

Very friendly and great with answering my questions. Nice and pleasant atmosphere. Melissa is very nice and courteous. I recommend this company.

Vicki Frost

Very reasonable on insurance and their staff is very helpful and friendly!!

Curt Counts

Garry Stapel

Regina Godinez

Best service. Great customer service. Super fast whatever you need, they’ll make sure you get it! You, ladies, are the best!

Gina Michelle

Positive: Professionalism, Responsiveness

Chelsey Peterson